Strategic Marketing and Execution: The Key to CardX's Fintech Triumph

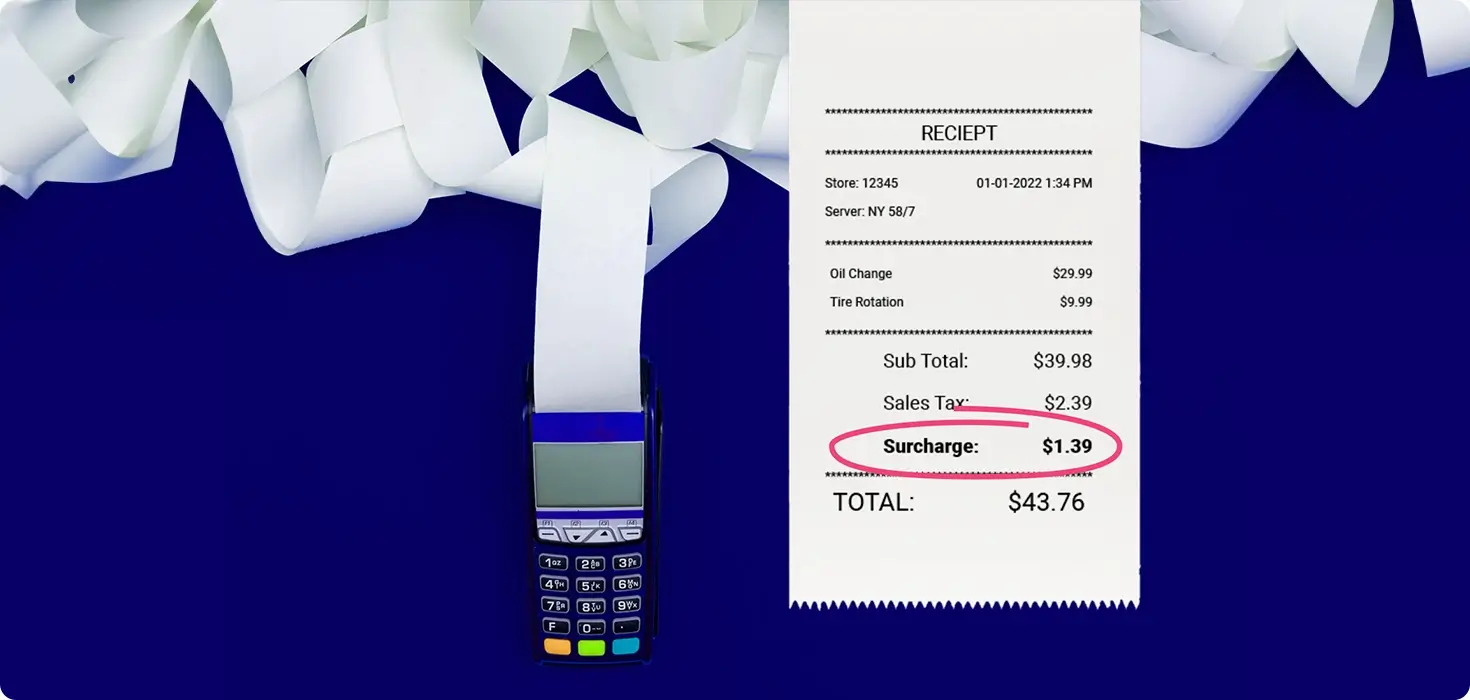

CardX gives small businesses a solution to pass on credit card fees to customers, offering them a way to avoid expenses they’d typically incur on the consumer’s behalf. This innovative approach aimed to reshape how businesses handle transaction costs.

The Challenge:

To create scalable demand, CardX needed to educate businesses about the benefits and legal aspects of credit card surcharging. The goal was to dispel the stigma often associated with credit card processing fees, proving that surcharging can be both fair and transparent.

Our Solution “The Convert Framework”

Phase 1: Foundation & Analytics

We started by beefing up CardX’s digital backbone:

- Analytics: Implemented detailed tracking across digital campaigns to pinpoint where we’re winning.

- SEO & CRO: Boosted website speed, streamlined UX, and fine-tuned the conversion flow.

- Feedback Systems: Integrated a sales feedback loop to allow pivots backed by real customer feedback.

Phase 2: Capture Demand

With the foundation set, we focused on capturing high-intent prospects:

- Inbound Lead-Gen: Deployed a vertical-specific acquisition strategy with tailored ads and baseline educational content across multiple touch points, nurturing leads to conversion.

- Funnel Movement: Focused on intensifying conversion efforts by enhancing engagement and trust-building strategies for leads already within the funnel.

Phase 3: Create Demand

To foster new demand, we initiated targeted educational campaigns:

- Educational Campaign: Launched ‘Surcharging 101’ a social creative campaign and digital content that clarified the advantages of surcharging, addressing common misconceptions and regulatory concerns.